What Is VAT? A Simple Explanation for Beginners

Introduction

VAT sounds like something designed to scare normal people away from invoices.

In reality, it’s much simpler than it looks.

VAT (Value Added Tax) is a consumption tax applied to goods and services at different stages of production and sale. You probably pay it every day often without noticing.

This guide explains what VAT is, how it works, who pays it and why governments rely on it using clear logic and real world examples.

Table of Contents

- What Is VAT?

- What Does “Value Added” Mean?

- VAT vs Sales Tax: What’s the Difference?

- Who Pays VAT?

- Net Price, VAT Amount, and Gross Price Explained

- VAT Inclusive vs VAT Exclusive Prices

- How VAT Is Calculated

- VAT Differs by Country

- Why Governments Use VAT

- Trusted Sources and References

- Final Thoughts

What Is VAT?

VAT stands for Value Added Tax.

In simple terms:

VAT is a tax charged on the value added to a product or service at each stage before it reaches the final customer.

Businesses collect VAT on behalf of the government. The final consumer usually pays the full amount as part of the price.

VAT is used in many countries, including the UK, UAE, Saudi Arabia and across the European Union.

What Does “Value Added” Mean?

“Value added” just means extra value created at each step.

For example:

- A supplier sells raw materials

- A manufacturer turns them into a product

- A retailer sells the finished item

Each step increases the value. VAT applies only to that increase, not the entire price again and again. That structure prevents double taxation and keeps the system fair.

VAT vs Sales Tax: What’s the Difference?

VAT and sales tax often get mixed up, but they work differently.

- VAT is charged at every stage of the supply chain

- Sales tax applies only at the final sale

- VAT allows businesses to reclaim tax paid on expenses

Because of this system, VAT is harder to avoid and easier for governments to track.

Who Pays VAT?

The short answer: the customer.

The longer answer:

- Businesses charge VAT on taxable sales

- Businesses reclaim VAT paid on eligible expenses

- Governments receive the net VAT amount

Businesses act as collectors. Consumers carry the final cost.

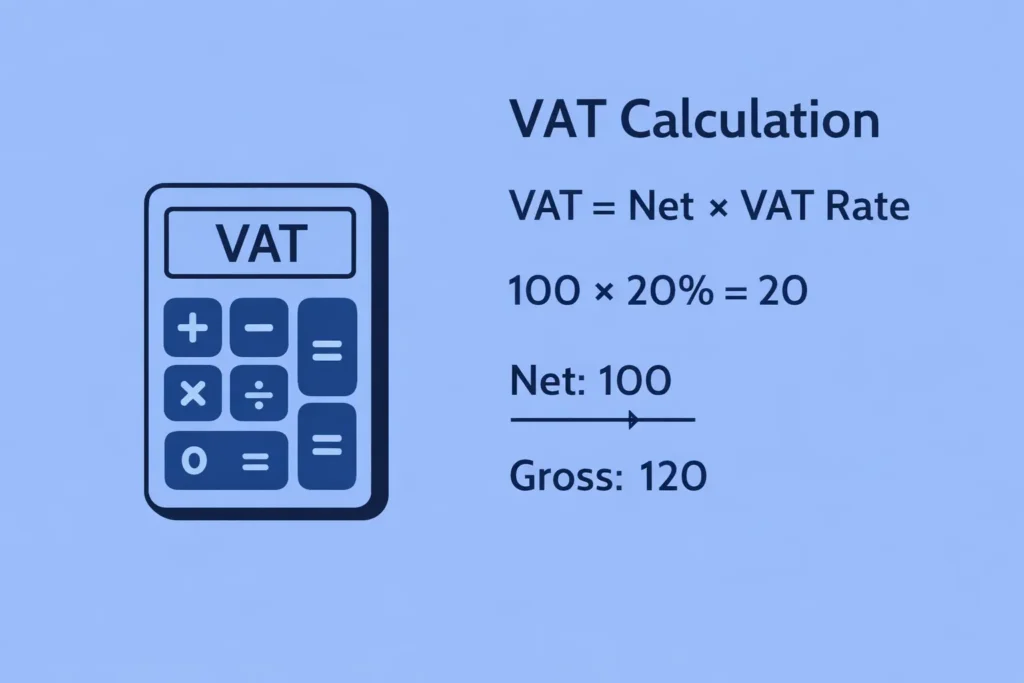

Net Price, VAT Amount and Gross Price Explained

These three terms explain almost everything about VAT.

- Net price: Price before VAT

- VAT amount: The tax charged

- Gross price: Net price plus VAT

Example:

- Net price: 100

- VAT (20%): 20

- Gross price: 120

Once you understand this structure, VAT calculations become predictable.

VAT Inclusive vs VAT Exclusive Prices

This is where confusion usually starts.

- VAT-exclusive price: VAT is added later

- VAT-inclusive price: VAT is already included

Retail prices are usually VAT-inclusive. Business invoices often show VAT separately. Knowing the difference helps avoid pricing and accounting mistakes.

How VAT Is Calculated?

The basic VAT formula is universal.

- VAT amount = Net price × VAT rate

- Gross price = Net price + VAT

To remove VAT from a price:

- Gross price ÷ (1 + VAT rate)

The formula stays the same. Only the rate changes by country.

You can calculate VAT manually or use a calculator for accuracy.

VAT Differs by Country

VAT rules are not identical worldwide.

Rates, exemptions and registration thresholds vary depending on location. That’s why VAT should always be calculated using country-specific rules.

You can calculate VAT using:

Each tool applies the correct local logic.

Why Governments Use VAT

Governments rely on VAT because it:

- Generates stable revenue

- Applies fairly to consumption

- Reduces large-scale tax evasion

- Scales with economic activity

VAT helps, fund to public services such as infrastructure, healthcare, and education.

Trusted Sources and References

This article is based on official guidance and internationally accepted tax frameworks:

These sources define how VAT works globally and ensure accuracy.

Final Thoughts

VAT is not mysterious. It’s structured.

Once you understand:

- Value added

- Net vs gross pricing

- Inclusive vs exclusive VAT

Everything clicks.

You don’t need to like VAT.

You just need to understand it.