Introduction

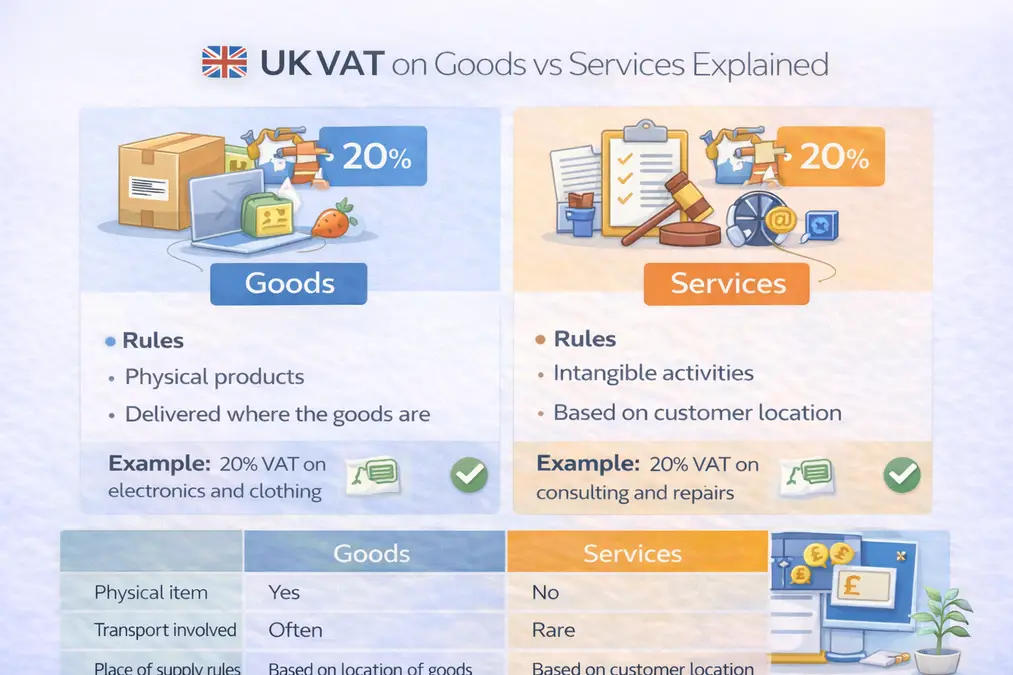

VAT in the UK applies differently to goods and services depending on the type of supply and where it is provided. Understanding the difference between UK VAT on goods vs services is essential for applying the correct VAT rate, determining the place of supply, and completing VAT returns accurately.

While the VAT rate may often be the same, the rules governing goods and services can differ significantly. This guide explains how VAT applies to each, highlights key distinctions, and provides simple examples to help businesses stay compliant.

Table of Contents

- What Is VAT on Goods?

- What Is VAT on Services?

- Key Differences Between Goods and Services for VAT

- Place of Supply Rules

- VAT Threshold 2024 and Goods vs Services

- VAT on Mixed Supplies

- Common Mistakes with Goods and Services

- Use a UK VAT Calculator

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Is VAT on Goods?

Goods are physical products that can be touched or transported.

Examples include:

- Electronics

- Clothing

- Furniture

- Food products

Most goods in the UK are subject to the standard VAT rate of 20%, unless reduced-rated or zero-rated.

What Is VAT on Services?

Services are intangible activities provided by a business.

Examples include:

- Consulting

- Legal advice

- Repairs

- Digital services

VAT is normally charged at 20%, but place-of-supply rules may affect how VAT applies, especially for international services.

Key Differences Between Goods and Services for VAT

| Feature | Goods | Services |

|---|---|---|

| Physical item | Yes | No |

| Transport involved | Often | Rare |

| Place of supply rules | Based on location of goods | Based on customer location |

| International VAT complexity | Medium | Higher |

Place of Supply Rules

The place of supply determines where VAT is due.

For Goods:

VAT is generally charged where the goods are delivered.

For Services:

VAT depends on:

- Whether the customer is a business (B2B)

- Whether the customer is a consumer (B2C)

- The country where the customer belongs

These rules are especially important for cross-border transactions.

VAT Threshold 2024 and Goods vs Services

The VAT threshold 2024 (£90,000) applies to taxable turnover from both goods and services combined.

Businesses supplying either must monitor total turnover.

VAT on Mixed Supplies

Some businesses supply both goods and services together.

For example:

- Installing equipment (goods + service)

- Selling software with support

In such cases, VAT treatment depends on whether the supply is:

- A single composite supply, or

- Separate supplies

Correct classification prevents VAT errors.

Common Mistakes with Goods and Services

- Charging VAT incorrectly on international services

- Applying zero-rate incorrectly

- Confusing exempt services with zero-rated goods

Use a UK VAT Calculator

To ensure accurate VAT amounts:

VAT calculation for UK companies

External Authority Reference

HMRC – VAT on Goods and Services

Frequently Asked Questions

Is VAT different for goods and services in the UK?

The VAT rate is often the same, but the rules for determining where VAT is charged can differ.

Do goods and services count toward the VAT threshold?

Yes. Both count toward the £90,000 VAT threshold 2024.

Are services harder to apply VAT to?

Services can be more complex, especially for international transactions.

Key Takeaways

- Goods are physical; services are intangible

- VAT rate is usually 20%

- Place-of-supply rules differ

- Both count toward VAT threshold 2024

- Correct classification prevents penalties