Introduction

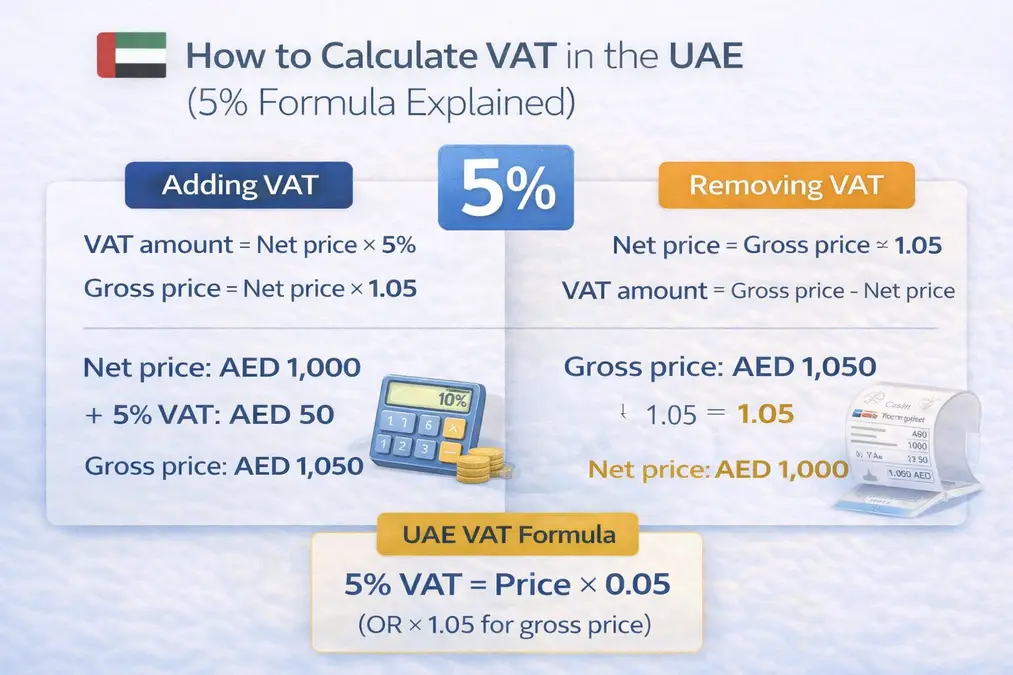

Understanding UAE VAT calculation is essential for businesses and individuals dealing with taxable supplies. The UAE applies a standard VAT rate of 5%, which means VAT calculations are straightforward — but mistakes can still occur when prices are VAT-inclusive or VAT-exclusive.

This guide explains how to calculate VAT in the UAE step by step, including how to add VAT and how to remove VAT from a price.

UAE VAT Rate Overview

The standard VAT rate in the UAE is:

- 5%

Some supplies may be zero-rated or exempt, but most commercial transactions apply 5%.

How to Add VAT (From Net Price)

When the price does NOT include VAT:

Formula:

VAT amount = Net price × 5%

Gross price = Net price × 1.05

Example:

- Net price: AED 1,000

- VAT (5%): AED 50

- Gross price: AED 1,050

How to Remove VAT (From VAT-Inclusive Price)

When VAT is already included:

Formula:

Net price = Gross price ÷ 1.05

VAT amount = Gross price − Net price

Example:

- Gross price: AED 1,050

- Net price: AED 1,000

- VAT: AED 50

⚠ Never subtract 5% directly from the gross price — always divide.

VAT Payable Formula (For Businesses)

Businesses must calculate VAT payable as:

VAT payable = Output VAT − Input VAT

- Output VAT: VAT charged to customers

- Input VAT: VAT paid on purchases

Common UAE VAT Calculation Mistakes

- Subtracting 5% directly from gross price

- Using wrong multiplier (should be 1.05)

- Forgetting zero-rated vs exempt difference

- Not tracking taxable turnover properly

Registration threshold explained

When VAT Calculation Becomes Complex

VAT calculation may require extra care when:

- Supplies are partially exempt

- Cross-border services are involved

- Mixed supplies are provided

- Reverse charge applies

Use a UAE VAT Calculator

To avoid errors:

👉 https://vatcalculatorhub.com/uae-vat-calculator/

External Authority Reference

UAE Federal Tax Authority (FTA)

https://tax.gov.ae

(nofollow, noopener)

Frequently Asked Questions

What is the VAT rate in the UAE?

The standard VAT rate is 5%.

How do I calculate VAT in the UAE?

Multiply the net price by 0.05 to get VAT, or multiply by 1.05 to get the total.

How do I remove VAT from a price?

Divide the VAT-inclusive amount by 1.05.

Key Takeaways

- UAE VAT rate is 5%

- Add VAT using ×1.05

- Remove VAT using ÷1.05

- Businesses calculate VAT payable using output minus input VAT

- Calculators reduce risk of mistakes