Introduction

Value Added Tax (VAT) was introduced in the United Arab Emirates on 1 January 2018. The UAE applies a standard VAT rate of 5% on most goods and services. Although the rate is lower than many other countries, businesses must still follow strict registration, calculation, and reporting rules.

This guide explains UAE VAT in simple terms, including how it works, who must register, and how VAT is calculated. Whether you are starting a business or already operating in the UAE, understanding VAT obligations helps ensure compliance and avoid penalties.

Table of Contents

- What Is VAT in the UAE?

- UAE VAT Rate

- How UAE VAT Works

- Who Must Register for VAT in the UAE?

- UAE VAT Example

- Filing VAT Returns in the UAE

- Use a UAE VAT Calculator

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Is VAT in the UAE?

UAE VAT is a consumption tax applied at each stage of the supply chain. Businesses collect VAT from customers and pay it to the Federal Tax Authority (FTA).

Consumers ultimately bear the VAT cost, while businesses act as tax collectors.

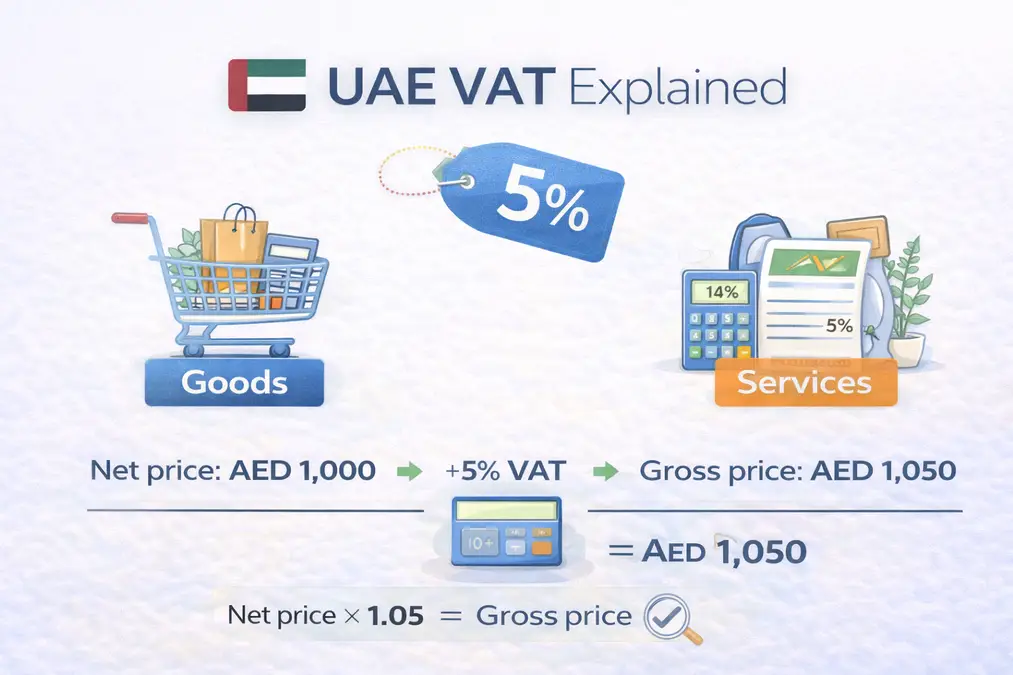

UAE VAT Rate

The UAE applies:

- Standard VAT rate: 5%

- Some supplies may be zero-rated

- Certain services may be exempt

Compared to many countries, 5% is relatively low, but compliance requirements remain strict.

How UAE VAT Works

The VAT process in the UAE follows a standard structure:

- Business sells goods/services

- Adds 5% VAT

- Customer pays total

- Business submits VAT return to FTA

The VAT payable is calculated as:

VAT payable = Output VAT − Input VAT

Who Must Register for VAT in the UAE?

VAT registration in the UAE is required when taxable supplies exceed a specific threshold.

- Mandatory registration threshold: AED 375,000

- Voluntary registration threshold: AED 187,500

Businesses must monitor turnover carefully to avoid late registration penalties.

UAE VAT Example

Example:

- Net price: AED 1,000

- VAT (5%): AED 50

- Gross price: AED 1,050

Formula:

Gross price = Net price × 1.05

Zero-Rated vs Exempt Supplies in the UAE

Understanding the difference is important:

- Zero-rated: VAT charged at 0%, input VAT recoverable

- Exempt: No VAT charged, input VAT generally not recoverable

Examples vary depending on sector.

Filing VAT Returns in the UAE

VAT-registered businesses must:

- Keep proper accounting records

- Submit VAT returns (usually quarterly)

- Pay VAT within deadlines

Failure to comply may result in administrative penalties.

Use a UAE VAT Calculator

To calculate VAT quickly and avoid errors:

External Authority Reference

UAE Federal Tax Authority (FTA)

Frequently Asked Questions

What is the VAT rate in the UAE?

The standard VAT rate in the UAE is 5%.

When was VAT introduced in the UAE?

VAT was introduced on 1 January 2018.

Who regulates VAT in the UAE?

VAT is regulated by the Federal Tax Authority (FTA).

Key Takeaways

- UAE VAT rate is 5%

- Businesses must register above AED 375,000 turnover

- VAT is collected by businesses and paid to FTA

- Input VAT can be reclaimed (if eligible)

- Accurate records prevent penalties