Introduction

The UAE VAT registration threshold determines when a business must register for VAT with the Federal Tax Authority (FTA). Not all businesses are required to register immediately, but once taxable supplies exceed a specific turnover limit, VAT registration becomes mandatory.

This guide explains the current UAE VAT registration threshold, how taxable turnover is calculated, and the difference between mandatory and voluntary registration.

- What Is the UAE VAT Registration Threshold?

- How Is Taxable Turnover Calculated?

- When Must You Register for VAT in the UAE?

- Voluntary VAT Registration in the UAE

- What Happens If You Register Late?

- How to Register for VAT in the UAE

- Track Turnover Accurately

- External Authority Reference

- Frequently Asked Questions

- Key Takeaways

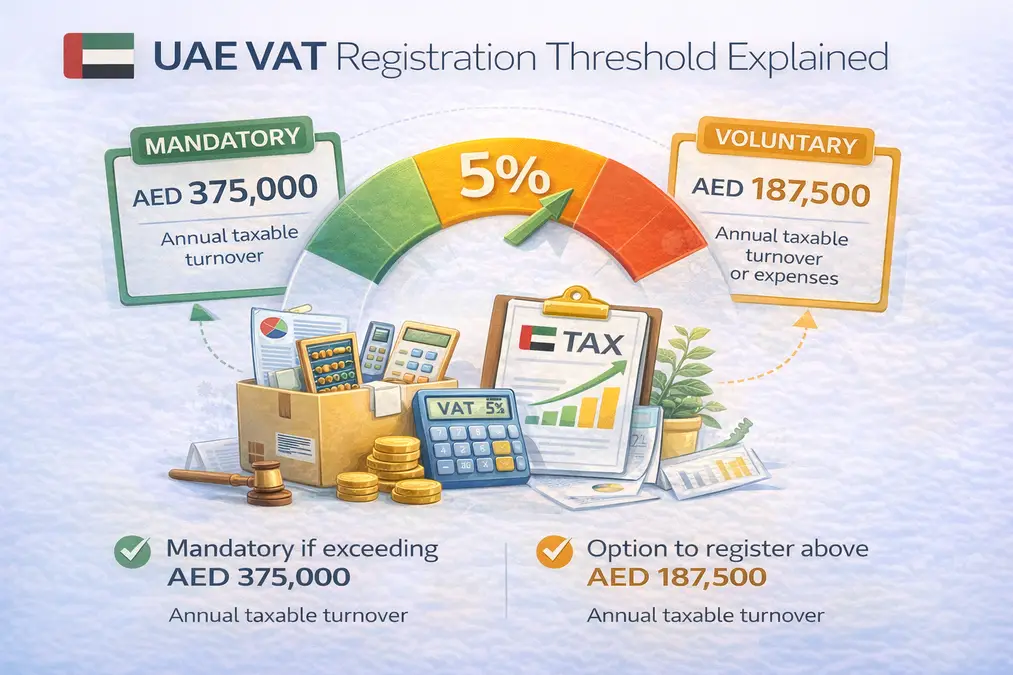

What Is the UAE VAT Registration Threshold?

The UAE applies two key thresholds:

✅ Mandatory Registration Threshold

- AED 375,000 in taxable supplies per year

✅ Voluntary Registration Threshold

- AED 187,500 in taxable supplies or taxable expenses

Businesses must monitor turnover carefully to avoid late registration penalties.

How Is Taxable Turnover Calculated?

Taxable turnover includes:

- Standard-rated supplies (5%)

- Zero-rated supplies

- Imports subject to VAT

It does NOT include:

- Exempt supplies

- Out-of-scope income

When Must You Register for VAT in the UAE?

You must register if:

- Your taxable supplies exceed AED 375,000 in the past 12 months, OR

- You expect taxable supplies to exceed this amount in the next 30 days

Failure to register on time can result in administrative penalties.

Voluntary VAT Registration in the UAE

Businesses below AED 375,000 may still register voluntarily if:

- Taxable supplies exceed AED 187,500

- Taxable expenses exceed AED 187,500

Voluntary registration allows businesses to reclaim input VAT but requires ongoing compliance.

What Happens If You Register Late?

Late registration may lead to:

- Financial penalties

- Backdated VAT liabilities

- Compliance risks

The FTA may impose fixed penalties for delayed registration.

How to Register for VAT in the UAE

Registration is done through the Federal Tax Authority (FTA) online portal (Non UAE PASS users).

You will need:

- Trade license

- Emirates ID / passport

- Financial records

- Turnover calculations

Track Turnover Accurately

Monitoring turnover monthly prevents accidental breaches of the threshold.

External Authority Reference

UAE Federal Tax Authority (FTA)

Frequently Asked Questions

What is the UAE VAT registration threshold?

AED 375,000 for mandatory registration and AED 187,500 for voluntary registration.

Is VAT registration automatic?

No. Businesses must apply through the FTA portal.

Can a business deregister from VAT?

Yes, if turnover falls below the deregistration threshold (subject to FTA approval).

Key Takeaways

- Mandatory threshold: AED 375,000

- Voluntary threshold: AED 187,500

- Taxable turnover includes zero-rated supplies

- Late registration leads to penalties

- Monthly tracking prevents compliance risks