Introduction

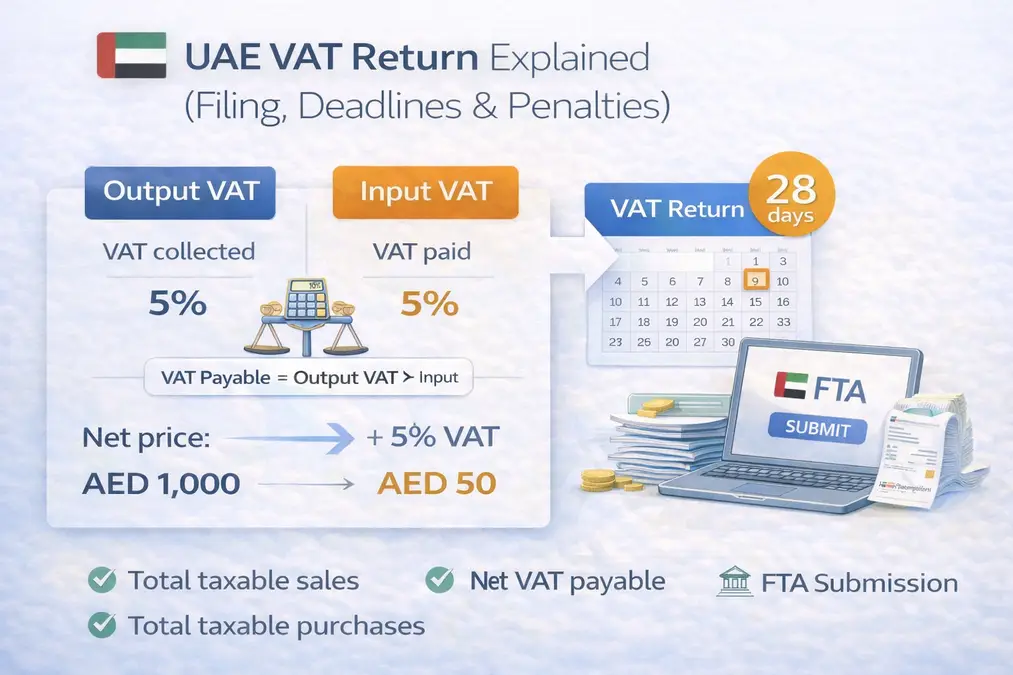

A UAE VAT return is the official report submitted to the Federal Tax Authority (FTA) showing how much VAT a business has collected and how much it has paid on expenses. VAT-registered businesses must file VAT returns regularly and pay any VAT due within the specified deadline.

Understanding how UAE VAT returns work helps businesses avoid penalties and remain compliant with FTA regulations.

What Is Included in a UAE VAT Return?

A standard UAE VAT return includes:

- Total taxable sales

- Output VAT collected (5%)

- Total taxable purchases

- Input VAT paid

- Net VAT payable or refundable

The final VAT payable is calculated as:

VAT Payable = Output VAT − Input VAT

How Often Must VAT Returns Be Filed?

Most businesses in the UAE file VAT returns:

- Quarterly (every 3 months)

In some cases, the FTA may assign monthly filing.

The VAT return period is specified in the VAT registration approval notice.

UAE VAT Return Deadline

VAT returns must be submitted:

- Within 28 days after the end of the tax period

Payment must also be made within the same deadline.

Late submission may trigger penalties.

How to File a UAE VAT Return

VAT returns are submitted through:

- The FTA e-Services portal

Steps:

- Log into FTA account

- Enter VAT figures

- Review calculations

- Submit return

- Pay VAT due

Common UAE VAT Return Mistakes

- Incorrect VAT calculations

- Missing taxable supplies

- Claiming non-recoverable input VAT

- Late submission

UAE Registration threshold explained

Penalties for Late VAT Returns

The FTA may impose:

- Fixed administrative penalties

- Late payment penalties

- Percentage-based fines

Timely filing avoids unnecessary financial costs.

Use a UAE VAT Calculator

To prepare accurate VAT return figures: UAE VAT calculation tool

External Authority Reference

UAE Federal Tax Authority – VAT Returns

Frequently Asked Questions

What is a UAE VAT return?

A VAT return reports VAT collected on sales and VAT paid on purchases to the FTA.

How often do I file a UAE VAT return?

Most businesses file quarterly.

What happens if I miss the VAT return deadline?

You may face administrative penalties and late payment fines.

Key Takeaways

- VAT returns report output and input VAT

- Most businesses file quarterly

- Deadline is 28 days after tax period

- Late filing results in penalties

- Accurate calculations reduce compliance risks