Introduction

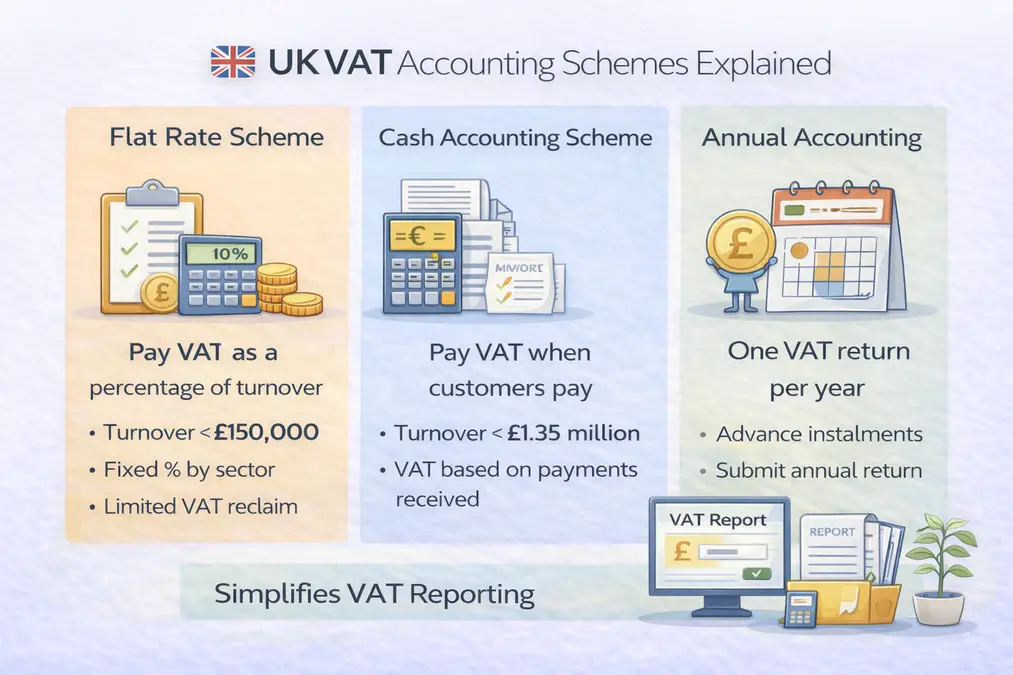

UK VAT accounting schemes are designed to simplify VAT reporting for eligible businesses. Instead of using standard VAT accounting, businesses may choose alternative methods such as the Flat Rate Scheme, Cash Accounting Scheme, or Annual Accounting Scheme.

These schemes can reduce administrative work, improve cash flow management, or simplify VAT calculations. However, eligibility rules apply, and choosing the wrong scheme can increase VAT costs. This guide explains each UK VAT accounting scheme in clear terms so you can understand which option may suit your business.

Table of Contents

- What Are UK VAT Accounting Schemes?

- How to Choose the Right VAT Scheme

- How VAT Schemes Affect VAT Returns

- Calculate VAT Before Choosing a Scheme

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Are UK VAT Accounting Schemes?

VAT accounting schemes are alternative methods of calculating and reporting VAT to HMRC. They aim to make VAT compliance easier for smaller businesses.

Most small businesses eligible for VAT registration under the VAT threshold 2024 (£90,000) may qualify for one of these schemes.

1. Flat Rate Scheme

The Flat Rate Scheme allows businesses to pay VAT as a fixed percentage of their gross turnover instead of calculating VAT on each transaction.

Key Features:

- Available if turnover is £150,000 or less (excluding VAT)

- A fixed percentage applies based on business sector

- Input VAT generally cannot be reclaimed (with limited exceptions)

When It Helps:

- Businesses with low VAT on purchases

- Simple service-based businesses

2. Cash Accounting Scheme

The Cash Accounting Scheme allows businesses to account for VAT only when payments are received from customers.

Key Benefits:

- Improves cash flow

- Reduces risk of paying VAT before customers pay

Eligibility:

- Taxable turnover up to £1.35 million

This scheme is useful for businesses with slow-paying clients.

3. Annual Accounting Scheme

The Annual Accounting Scheme allows businesses to submit one VAT return per year instead of quarterly returns.

How It Works:

- Make advance instalments throughout the year

- Submit one final VAT return annually

- Pay or reclaim any remaining VAT balance

This reduces administrative workload but requires budgeting for instalments.

How to Choose the Right VAT Scheme

Consider:

- Your turnover level

- Cash flow needs

- Amount of input VAT

- Administrative capacity

For some businesses, the standard VAT method may still be more beneficial.

How VAT Schemes Affect VAT Returns

Even under alternative schemes, businesses must:

- Keep digital records (MTD compliant)

- Submit returns on time

- Apply correct VAT rates

Calculate VAT Before Choosing a Scheme

Understanding VAT calculations is essential before selecting a scheme.

Online Calculator

External Authority Reference

Frequently Asked Questions

What is the Flat Rate Scheme?

A simplified VAT method where VAT is paid as a fixed percentage of turnover.

Who can use the Cash Accounting Scheme?

Businesses with turnover up to £1.35 million may qualify.

Is the Annual Accounting Scheme easier?

It reduces filing frequency but requires advance instalments.

Key Takeaways

- UK VAT accounting schemes simplify VAT reporting

- Flat Rate Scheme uses a fixed percentage

- Cash Accounting improves cash flow

- Annual Accounting reduces filing frequency

- Choosing the right scheme depends on business needs