Introduction

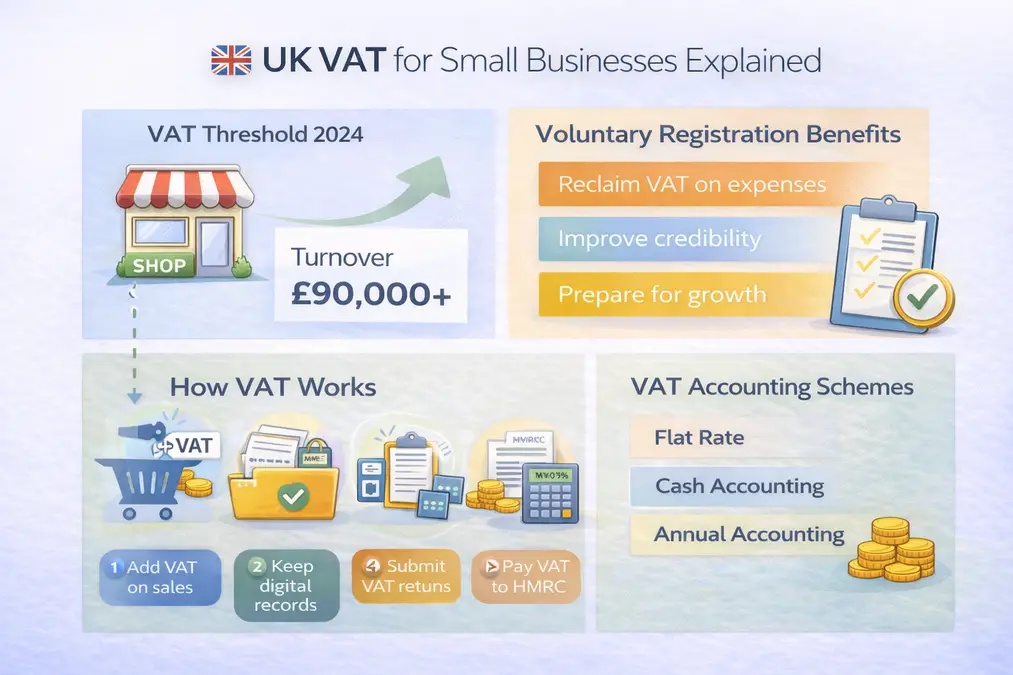

Understanding UK VAT for small businesses is essential for staying compliant and avoiding unexpected penalties. While not all small businesses need to register for VAT, those approaching the VAT threshold 2024 (£90,000) must monitor turnover carefully.

This guide explains when small businesses must register for VAT, how VAT works once registered, and practical steps to manage VAT correctly. Whether you are a sole trader, freelancer, or limited company director, knowing your VAT responsibilities helps you plan growth confidently.

Table of Contents

- Do Small Businesses Need to Register for VAT?

- Voluntary VAT Registration for Small Businesses

- How VAT Works for Small Businesses

- Choosing the Right VAT Scheme

- Common VAT Challenges for Small Businesses

- VAT and Cash Flow Management

- Using a UK VAT Calculator

- External Reference

- Frequently Asked Questions

- Key Takeaways

Do Small Businesses Need to Register for VAT?

Small businesses must register for VAT if their taxable turnover exceeds the VAT threshold 2024 of £90,000 within a rolling 12-month period.

If turnover stays below this limit, registration is optional.

Voluntary VAT Registration for Small Businesses

Many small businesses choose to register voluntarily.

Reasons include:

- Reclaiming VAT on business expenses

- Improving credibility with VAT-registered clients

- Preparing for rapid growth

However, registration means charging VAT on sales and filing VAT returns.

How VAT Works for Small Businesses

Once registered, small businesses must:

- Add VAT to taxable sales

- Keep digital VAT records

- Submit VAT returns (usually quarterly)

- Pay or reclaim VAT

Choosing the Right VAT Scheme

Small businesses may qualify for simplified VAT schemes.

Common options:

- Flat Rate Scheme

- Annual Accounting Scheme

- Cash Accounting Scheme

These schemes can reduce administrative burden but must be chosen carefully.

Common VAT Challenges for Small Businesses

Small businesses often struggle with:

- Monitoring turnover accurately

- Understanding VAT-inclusive vs exclusive pricing

- Applying correct VAT rates

- Cash flow pressure from VAT payments

VAT and Cash Flow Management

VAT collected from customers does not belong to the business — it must be paid to HMRC.

To manage cash flow:

- Set aside VAT collected

- Track VAT liabilities monthly

- Use accounting software compatible with MTD

Using a UK VAT Calculator

To track VAT amounts accurately:

External Authority Reference

HMRC – VAT for Small Businesses – Register

Frequently Asked Questions

What is the VAT threshold 2024 for small businesses?

The threshold is £90,000 in taxable turnover over a rolling 12 months.

Can a small business avoid VAT?

If turnover stays below the threshold and registration is not voluntary, VAT registration is not required.

Is VAT difficult for small businesses?

It can be manageable with proper record-keeping and correct calculation methods.

Key Takeaways

- VAT registration is mandatory above £90,000 turnover

- Voluntary registration is possible below the threshold

- Small businesses must file VAT returns once registered

- Correct pricing and calculation are essential

- Tracking turnover prevents late registration