Introduction

In the UK, prices may be shown including VAT or excluding VAT, depending on who the customer is and how the price is presented. Confusing VAT-inclusive and VAT-exclusive prices is a common cause of incorrect VAT calculations, pricing errors, and invoice disputes.

This guide explains UK VAT inclusive vs exclusive prices, how to recognise each one, and how to calculate VAT correctly in both cases. With simple examples, you’ll understand when VAT needs to be added, when it needs to be removed, and how this affects the final amount paid.

Table of Contents

- What Is a VAT Exclusive Price in the UK?

- What Is a VAT Inclusive Price in the UK?

- UK VAT Inclusive vs Exclusive: Key Differences

- How to Convert VAT Exclusive to VAT Inclusive

- How to Convert VAT Inclusive to VAT Exclusive

- Why This Matters for UK Businesses

- Calculate UK VAT Instantly

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Is a VAT Exclusive Price in the UK?

A VAT exclusive price (also called a net price) is a price before VAT is added.

VAT-exclusive pricing is commonly used when:

- Quoting prices to other businesses

- Issuing VAT invoices

- Displaying trade or wholesale prices

Example (UK Standard Rate)

- Net price: 100

- VAT (20%): 20

- Gross price: 120

Calculation method explained:

Internal link: https://vatcalculatorhub.com/uk-vat-calculation/

What Is a VAT Inclusive Price in the UK?

A VAT inclusive price (also called a gross price) already includes VAT in the displayed amount.

VAT-inclusive pricing is commonly used for:

- Consumer prices

- Retail stores

- Online shops

Example

- Displayed price: 120

- VAT included (20%)

- Net price: 100

How to extract VAT correctly:

Internal link: https://vatcalculatorhub.com/remove-vat-from-price/

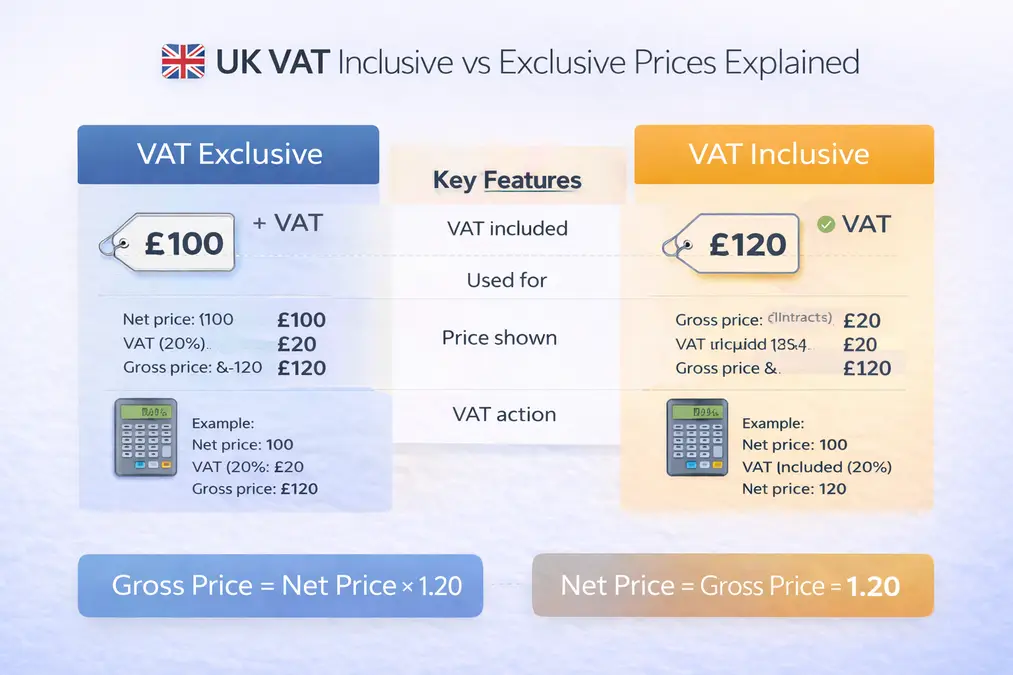

UK VAT Inclusive vs Exclusive: Key Differences

| Feature | VAT Exclusive | VAT Inclusive |

|---|---|---|

| VAT included | ❌ No | ✅ Yes |

| Used for | Businesses | Consumers |

| Price shown | Lower | Final amount |

| VAT action | Add VAT | Remove VAT |

Understanding this difference ensures VAT is calculated correctly every time.

How to Convert VAT Exclusive to VAT Inclusive

When VAT is not included, use this formula:

Gross price = Net price × 1.20

This applies to the UK standard VAT rate of 20%.

Full formula breakdown:

Internal link: https://vatcalculatorhub.com/vat-calculation-formula/

How to Convert VAT Inclusive to VAT Exclusive

When VAT is already included, never subtract VAT directly.

Correct Formula

Net price = Gross price ÷ 1.20

This ensures the VAT amount is calculated accurately.

Step-by-step guide:

Internal link: https://vatcalculatorhub.com/calculate-vat-backwards/

Why This Matters for UK Businesses

Using the wrong price type can result in:

- Incorrect invoices

- Under- or over-charging VAT

- Errors on VAT returns

UK businesses must clearly show whether prices are VAT inclusive or exclusive.

Calculate UK VAT Instantly

To avoid confusion, use a calculator designed for UK VAT.

Internal calculator link:

https://vatcalculatorhub.com/uk-vat-calculator/

External Reference

Frequently Asked Questions

Are UK prices usually VAT inclusive or exclusive?

Consumer prices are usually VAT inclusive, while business prices are often VAT exclusive.

Can I subtract VAT from a VAT-inclusive price?

No. You must divide by 1.20 for the UK standard rate.

Does VAT inclusive vs exclusive affect VAT owed?

No. It only affects how the price is shown, not how much VAT is due.

Key Takeaways

- VAT exclusive prices do not include VAT

- VAT inclusive prices already include VAT

- Different formulas apply to each

- Subtracting VAT directly is incorrect

- Using calculators reduces mistakes