Introduction

The VAT threshold 2024 determines whether a business in the UK must register for Value Added Tax. Not all businesses are required to register for VAT, but once taxable turnover exceeds a specific limit set by HMRC, registration becomes mandatory.

This guide explains the current VAT threshold in the UK for 2024, how it is calculated, what counts as taxable turnover, and what happens if your business temporarily exceeds the limit. The information is written in clear, practical terms for small businesses and sole traders.

Table of Contents

- What Is the VAT Threshold in the UK for 2024?

- How the VAT Threshold 2024 Is Measured

- What Counts as Taxable Turnover?

- Future Turnover Test (30-Day Rule)

- What If You Temporarily Exceed the VAT Threshold?

- Voluntary VAT Registration Below the Threshold

- How the VAT Threshold Changed in 2024

- Will the VAT Threshold Change Again?

- Track Your Turnover Accurately

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Is the VAT Threshold in the UK for 2024?

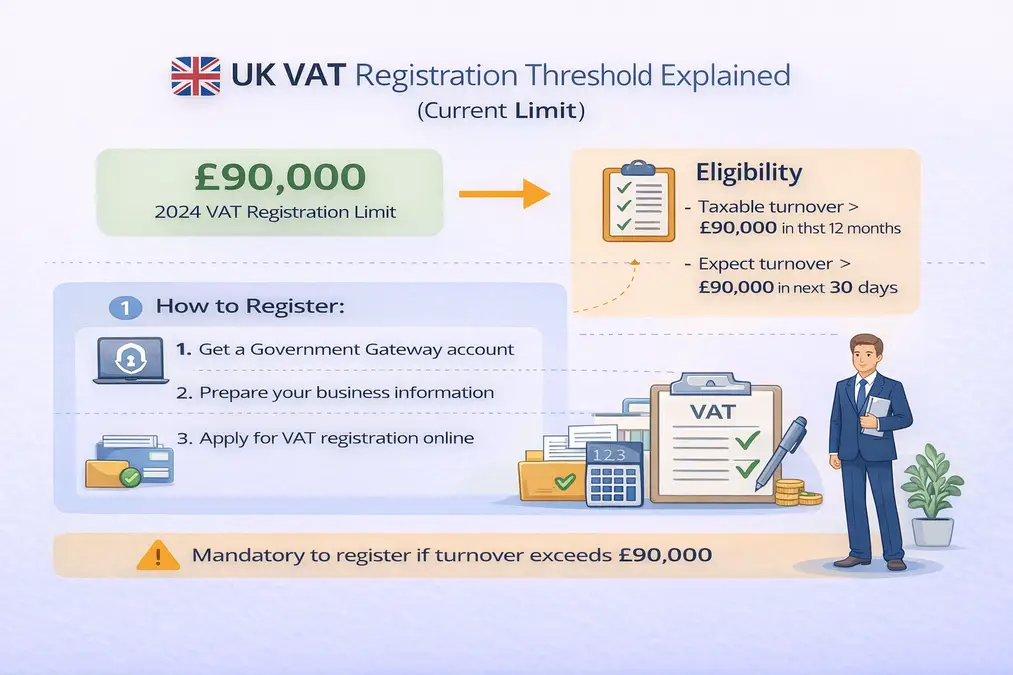

The VAT threshold 2024 is the annual taxable turnover limit at which a UK business must register for VAT.

Current VAT Threshold (2024)

- £90,000 taxable turnover

- Measured over a rolling 12-month period

- Applies across England, Scotland, Wales, and Northern Ireland

If your taxable turnover goes above this limit, VAT registration becomes compulsory.

How the VAT Threshold 2024 Is Measured

The VAT threshold is not based on the tax year.

Instead, HMRC checks:

- Any continuous 12-month period

- At the end of every month

If total taxable turnover in the previous 12 months exceeds £90,000, you must register for VAT.

What Counts as Taxable Turnover?

For VAT threshold purposes, taxable turnover includes:

- Standard-rated sales (20%)

- Reduced-rated sales (5%)

- Zero-rated sales (0%)

It does not include:

- VAT-exempt supplies

- Income outside the scope of VAT

- Certain capital asset sales

VAT basics reference: how VAT works in the UK

Future Turnover Test (30-Day Rule)

You must also register for VAT if:

- You expect taxable turnover to exceed £90,000 in the next 30 days alone

This often applies to:

- Large one-off contracts

- Seasonal spikes

- Rapid business growth

What If You Temporarily Exceed the VAT Threshold?

If your turnover exceeds the VAT threshold 2024 temporarily, you may apply to HMRC for an exception from registration.

HMRC may grant this if:

- The excess was due to a one-off event, and

- You can show turnover will fall below the VAT deregistration threshold (£88,000) in the next 12 months

HMRC will review your evidence before deciding.

Voluntary VAT Registration Below the Threshold

Even if your turnover is below £90,000, you can register voluntarily.

Businesses do this to:

- Reclaim VAT on expenses

- Improve credibility with VAT-registered clients

- Prepare for future growth

However, voluntary registration also means charging VAT on sales.

How the VAT Threshold Changed in 2024

Before April 2024:

- VAT registration threshold: £85,000

- Deregistration threshold: £83,000

From 1 April 2024:

- VAT threshold increased to £90,000

- Deregistration threshold increased to £88,000

This change was announced in the UK Budget to reduce pressure on small businesses.

Will the VAT Threshold Change Again?

As of now:

- The VAT threshold 2024 remains in place

- No confirmed date for further increases

- Thresholds may be reviewed in future budgets

Businesses should monitor updates regularly.

Track Your Turnover Accurately

To avoid accidental registration, regularly calculate your VAT turnover.

External Reference

HMRC – VAT Registration Guidance

Frequently Asked Questions

What is the VAT threshold in the UK for 2024?

The VAT threshold 2024 in the UK is £90,000 in taxable turnover, measured over a rolling 12-month period.

Has the VAT threshold increased in 2024?

Yes. From 1 April 2024, the UK government increased the VAT registration threshold from £85,000 to £90,000.

Is the VAT threshold based on a calendar year?

No. The VAT threshold is based on a rolling 12-month period, not the tax year or calendar year.

What happens if I exceed the VAT threshold temporarily?

If your turnover exceeds the threshold temporarily, you may apply to HMRC for an exception from VAT registration if you can show turnover will fall below £88,000 in the next 12 months.

Can I register for VAT below the threshold?

Yes. Businesses can register voluntarily for VAT even if turnover is below £90,000.

Does zero-rated income count toward the VAT threshold?

Yes. Zero-rated sales still count toward the VAT threshold, even though VAT is charged at 0%.

Does the VAT threshold apply across the whole UK?

Yes. The VAT threshold 2024 applies across England, Scotland, Wales, and Northern Ireland.

Key Takeaways

- The VAT threshold 2024 in the UK is £90,000

- The threshold is measured over a rolling 12-month period

- VAT registration can be triggered by past or expected future turnover

- Zero-rated sales count toward the threshold

- Businesses may apply for an exception if the threshold is exceeded temporarily

- Voluntary VAT registration is allowed below the threshold

- Tracking turnover regularly helps avoid late registration penalties