Introduction

Submitting a VAT return is a legal requirement for VAT-registered businesses in the UK. A VAT return shows how much VAT you have charged on sales, how much VAT you have paid on purchases, and whether you owe VAT to HMRC or are due a refund.

This guide explains UK VAT return basics in simple terms, including what information is included, how often VAT returns are filed, and common mistakes to avoid. It is designed for beginners and small business owners who want a clear understanding of the UK VAT return process.

Table of Contents

- What Is a UK VAT Return?

- What Information Is Included in a VAT Return?

- How Often Are VAT Returns Filed?

- How to Calculate VAT for Your Return

- Making Tax Digital (MTD) and VAT Returns

- Common UK VAT Return Mistakes

- When Is VAT Due?

- Use a UK VAT Calculator

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Is a UK VAT Return?

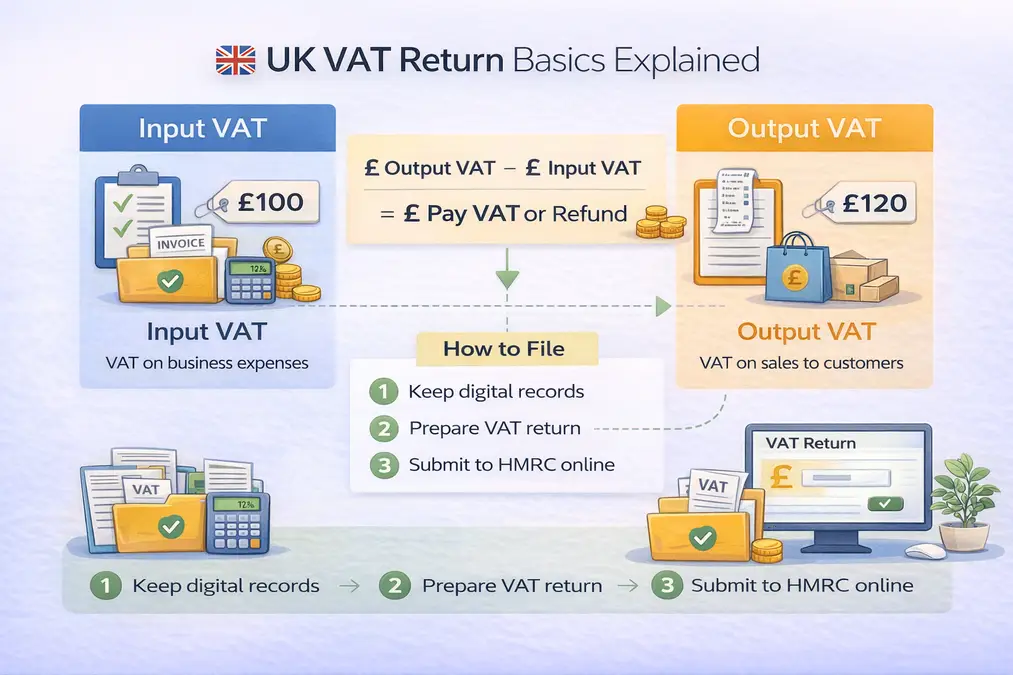

A UK VAT return is a report submitted to HMRC showing:

- VAT charged to customers (output VAT)

- VAT paid on business expenses (input VAT)

The difference between these amounts determines whether you:

- Pay VAT to HMRC, or

- Receive a VAT refund

What Information Is Included in a VAT Return?

A standard UK VAT return includes:

- Total sales (excluding VAT)

- Total purchases (excluding VAT)

- Output VAT

- Input VAT

- Net VAT payable or refundable

These figures must be accurate and based on valid records.

How Often Are VAT Returns Filed?

Most businesses file VAT returns:

- Quarterly (every 3 months)

Some businesses may file:

- Annually (Annual Accounting Scheme)

Learn about VAT schemes later in the UK VAT silo.

How to Calculate VAT for Your Return

VAT payable is calculated as:

VAT payable = Output VAT − Input VAT

Calculation explained step by step: UK VAT Calculation

Making Tax Digital (MTD) and VAT Returns

UK VAT returns must be submitted under Making Tax Digital (MTD) rules.

This means:

- Digital records must be kept

- VAT returns must be submitted using MTD-compatible software

Spreadsheets alone are no longer sufficient unless connected via approved software.

Common UK VAT Return Mistakes

Common errors include:

- Using the wrong VAT rate

- Missing invoices

- Claiming non-reclaimable VAT

- Late submission

When Is VAT Due?

VAT payment is usually due:

- 1 month + 7 days after the end of the VAT period

Late payments may result in penalties and interest.

Use a UK VAT Calculator

To reduce errors when preparing returns:

External Reference

HMRC – VAT Returns Guidance

Frequently Asked Questions

What is a UK VAT return?

A VAT return reports VAT charged on sales and VAT paid on purchases to HMRC.

How often do I submit a VAT return?

Most UK businesses submit VAT returns quarterly.

Do I need software to submit VAT returns?

Yes. VAT returns must be submitted using MTD-compatible software.

Key Takeaways

- VAT returns are mandatory for VAT-registered businesses

- Returns show input and output VAT

- Most are filed quarterly

- MTD rules require digital submission

- Errors can lead to penalties