Introduction

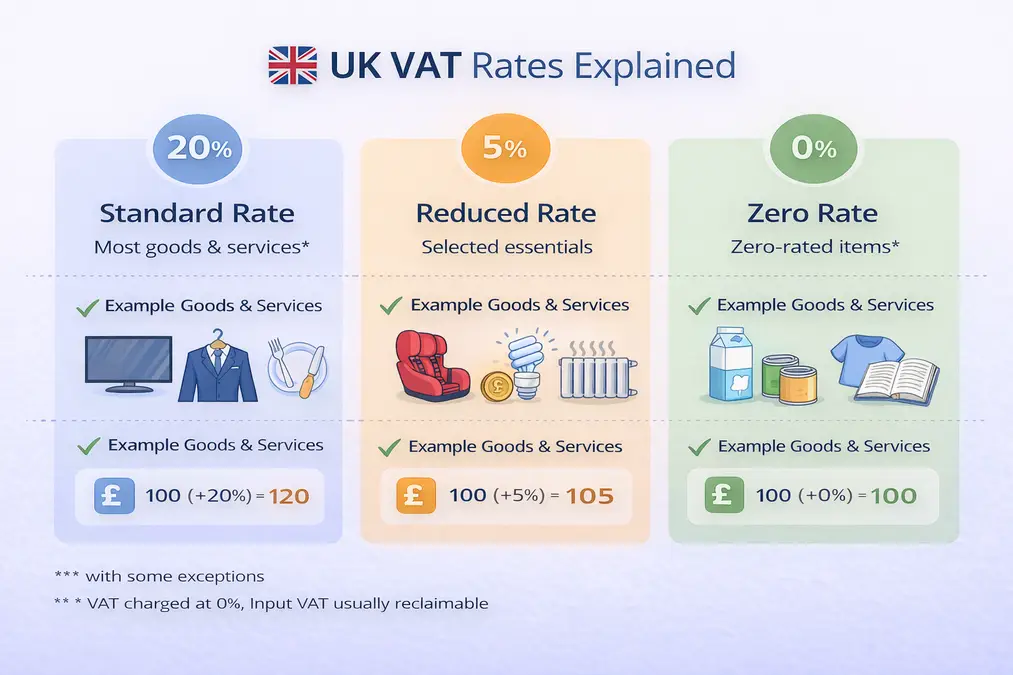

The United Kingdom uses different VAT rates depending on the type of goods or services being sold. Understanding which VAT rate applies is essential for pricing correctly, issuing invoices, and avoiding VAT errors.

This guide explains UK VAT rates in simple terms, covering the standard rate, reduced rate, and zero rate. You’ll also see practical examples so you can understand how each VAT rate affects the final price paid by customers.

Table of Contents

- What Are VAT Rates in the UK?

- Standard VAT Rate in the UK (20%)

- Reduced VAT Rate in the UK (5%)

- Zero Rate VAT in the UK (0%)

- Zero-Rated vs VAT Exempt (Important Difference)

- How UK VAT Rates Affect Pricing

- Calculate UK VAT Using the Correct Rate

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Are VAT Rates in the UK?

VAT rates determine how much VAT is added to a product or service.

In the UK, there are three main VAT rates:

- Standard rate

- Reduced rate

- Zero rate

Each rate applies to different categories of goods and services under UK tax rules.

Start with the basics: UK VAT Explained

Standard VAT Rate in the UK (20%)

The standard VAT rate in the UK is 20%.

This rate applies to most goods and services unless a specific exception exists.

Common examples:

- Electronics

- Clothing (adult)

- Professional services

- Restaurant meals

Example:

- Net price: 100

- VAT (20%): 20

- Gross price: 120

Learn how this is calculated: Formula for VAT calculation

Reduced VAT Rate in the UK (5%)

The reduced VAT rate of 5% applies to specific goods and services, often related to household essentials.

Common examples:

- Domestic fuel and power

- Children’s car seats

- Some energy-saving materials

Example:

- Net price: 100

- VAT (5%): 5

- Gross price: 105

Zero Rate VAT in the UK (0%)

The zero VAT rate means VAT is charged at 0%, not that VAT is ignored.

Businesses still:

- Record the sale

- May reclaim input VAT

Common examples:

- Most food items

- Children’s clothing

- Books and newspapers

Example:

- Net price: 100

- VAT (0%): 0

- Gross price: 100

Zero-Rated vs VAT Exempt (Important Difference)

- Zero-rated: VAT is charged at 0%, input VAT can be reclaimed

- Exempt: No VAT charged, input VAT usually cannot be reclaimed

Understanding this difference is critical for VAT reporting.

How UK VAT Rates Affect Pricing

Choosing the correct VAT rate ensures:

- Accurate pricing

- Correct invoices

- Proper VAT returns

Using the wrong rate can lead to underpayment or overpayment of VAT.

Learn how prices are displayed: Inclusive vs exclusive VAT

Calculate UK VAT Using the Correct Rate

To avoid mistakes, always apply the correct UK VAT rate when calculating VAT.

External Reference

For official UK VAT rate guidance, see:

HMRC – VAT Rates

Frequently Asked Questions

What is the standard VAT rate in the UK?

The standard VAT rate in the UK is 20%.

Are all goods charged at 20% VAT?

No. Some goods are reduced-rated or zero-rated.

Is zero-rated VAT the same as VAT exempt?

No. Zero-rated sales still count as taxable supplies.

Key Takeaways

- UK has three main VAT rates

- Standard rate is 20%

- Reduced rate is 5%

- Zero rate is 0%

- Correct VAT rate ensures compliance