Introduction

Knowing how to calculate VAT in the UK is essential for pricing goods and services correctly, checking invoices, and preparing VAT returns. UK VAT calculations follow a standard method, but mistakes often happen when VAT-inclusive and VAT-exclusive prices are confused.

This guide explains UK VAT calculation step by step, using simple formulas and practical examples. Whether you are adding VAT to a price or calculating VAT from a VAT-inclusive amount, the same principles apply across the UK.

Table of Contents

- Understanding UK VAT Prices

- UK VAT Calculation Formula (Standard Rate)

- How to Calculate VAT from a VAT-Inclusive Price

- UK VAT Calculation for Different Rates

- Common UK VAT Calculation Mistakes

- Calculate UK VAT

- External Reference

- Frequently Asked Questions

- Key Takeaways

Understanding UK VAT Prices

Before calculating VAT, you need to know whether a price is:

- VAT exclusive (net price) – VAT not included

- VAT inclusive (gross price) – VAT already included

Using the wrong method leads to incorrect results.

UK VAT basics – Explained Briefly

UK VAT Calculation Formula (Standard Rate)

The standard UK VAT rate is 20%.

Formula to Add VAT

VAT amount = Net price × VAT rate

Gross price = Net price × (1 + VAT rate)

Example

- Net price: 100

- VAT (20%): 20

- Gross price: 120

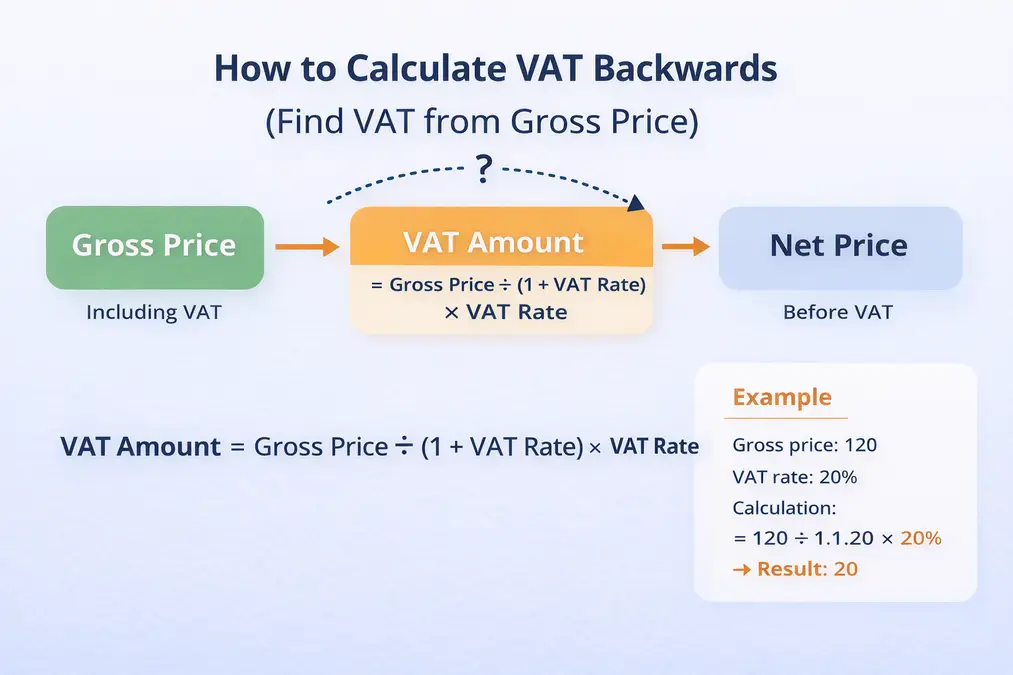

How to Calculate VAT from a VAT-Inclusive Price

When VAT is already included, you must divide, not subtract.

Reverse VAT Formula

Net price = Gross price ÷ 1.20

VAT amount = Gross price − Net price

Example

- Gross price: 120

- Net price: 100

- VAT amount: 20

Full explanation: remove VAT from price

UK VAT Calculation for Different Rates

UK VAT rates affect the multiplier used:

- 20% (standard): divide or multiply by 1.20

- 5% (reduced): divide or multiply by 1.05

- 0% (zero): no VAT added

Common UK VAT Calculation Mistakes

- Subtracting VAT directly from the gross price

- Using the wrong VAT rate

- Confusing inclusive and exclusive prices

Avoid these errors: VAT calculation mistakes

Calculate UK VAT

Manual calculations can lead to errors.

Using a calculator ensures accuracy.

Internal calculator link:

UK VAT calculator for businesses

External Reference

Frequently Asked Questions

How do I calculate VAT in the UK?

Multiply the net price by the VAT rate and add it to the net price.

How do I remove VAT from a price?

Divide the VAT-inclusive price by 1.20 for standard rate VAT.

Is the VAT calculation the same for all UK businesses?

Yes. Only the VAT rate may change depending on the goods or services.

Key Takeaways

- UK VAT standard rate is 20%

- VAT is calculated from the net price

- Reverse VAT uses division, not subtraction

- VAT rates affect the multiplier used

- Calculators reduce errors