Introduction

Sometimes you know the final price including VAT, but you need to work out how much VAT is included in that amount. This is known as calculating VAT backwards. It is a common requirement when reviewing invoices, checking receipts, or confirming VAT charged on VAT-inclusive prices.

This guide explains how to calculate VAT backwards step by step, shows the correct formula to use, and includes a simple example. The method works the same worldwide, even though VAT rates vary by country.

Table of Contents

- What Does “Calculating VAT Backwards” Mean?

- The VAT Backwards Formula

- Step-by-Step Example

- VAT Backwards vs Removing VAT – What’s the Difference?

- When Do You Need to Calculate VAT Backwards?

- Does VAT Backward Calculation Change by Country?

- External Reference

- Frequently Asked Questions

- Key Takeaways

What Does “Calculating VAT Backwards” Mean?

Calculating VAT backwards means finding:

- The VAT amount, and

- The net price

-when you only know the gross (VAT- inclusive) price.

This is different from removing VAT entirely here, the focus is on isolating the VAT amount.

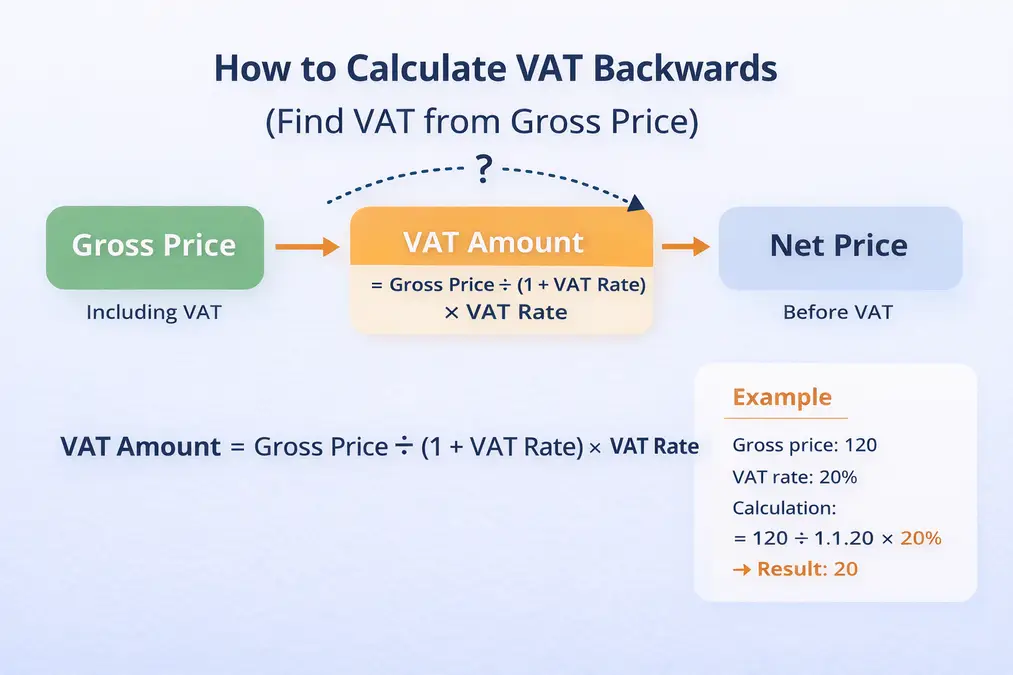

The VAT Backwards Formula

✅ Correct Formula to Find VAT Amount

VAT amount = Gross price ÷ (1 + VAT rate) × VAT rate

This formula ensures the VAT is calculated correctly from a VAT-inclusive price.

Step-by-Step Example

Example:

- Gross price: 120

- VAT rate: 20%

Step 1:

120 ÷ 1.20 = 100

Step 2:

100 × 20% = 20

✔ VAT amount = 20

✔ Net price = 100

To understand why division is required, read: Remove VAT from price

VAT Backwards vs Removing VAT – What’s the Difference?

- Removing VAT: Finds the net price only

- Calculating VAT backwards: Finds the VAT amount specifically

Both use division, but the end goal is different.

Related guide: VAT Calculation formula

When Do You Need to Calculate VAT Backwards?

This method is useful when you:

- Review VAT- inclusive invoices

- Audit receipts

- Verify VAT charged by suppliers

- Prepare VAT reports

It helps ensure accuracy and prevents over- or under-reporting VAT.

Does VAT Backward Calculation Change by Country?

No.

The formula stays the same, but the VAT rate changes.

Use country-specific calculators for accuracy:

External Reference

For official guidance on VAT- inclusive pricing, see:

European Commission – VAT Basics

Frequently Asked Questions

How do I calculate VAT backwards?

Divide the gross price by (1 + VAT rate), then multiply by the VAT rate.

Is this the same as removing VAT?

No. Removing VAT finds the net price; backward calculation isolates the VAT amount.

Does this work for any VAT rate?

Yes. Only the VAT percentage changes.

Key Takeaways

- VAT backwards calculation isolates VAT from a gross price

- Division is always required

- The method works worldwide

- VAT rates vary, formulas do not