Introduction

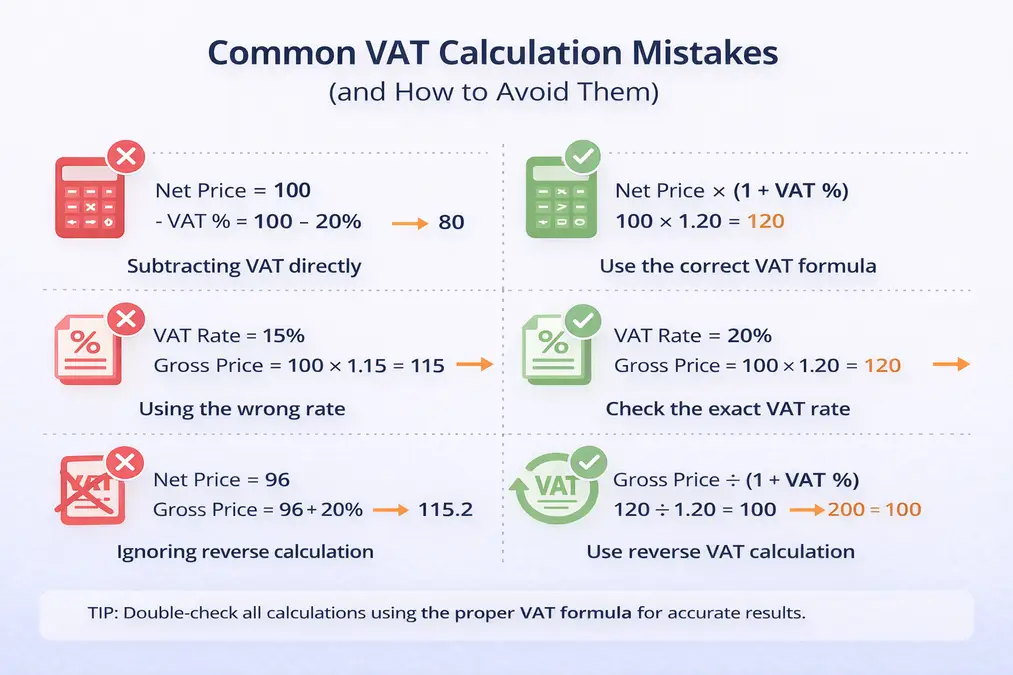

VAT calculations seem simple, but many people make small mistakes that lead to incorrect totals, pricing errors, or VAT reporting issues. These errors often happen when VAT is subtracted incorrectly, the wrong VAT rate is applied, or VAT-inclusive prices are misunderstood.

This guide covers the most common VAT calculation mistakes, explains why they happen, and shows how to avoid them using the correct VAT formulas. Whether you are checking invoices, preparing prices, or calculating VAT manually, understanding these pitfalls helps you stay accurate and compliant.

Table of Contents

- Calculation Mistakes

- How to Avoid VAT Calculation Mistakes

- External Reference

- Frequently Asked Questions

- Key Takeaways

Mistake 1: Subtracting VAT Directly from a Price

One of the most common errors is subtracting VAT as a percentage from a gross price.

Incorrect approach:

120 − 20% = ❌

Correct approach:

Net price = Gross price ÷ (1 + VAT rate)

Learn the correct method here: Reverse VAT calculation

Mistake 2: Using the Wrong VAT Rate

Applying the wrong VAT percentage leads to incorrect totals.

Common causes:

- Assuming a standard rate applies to everything

- Confusing country VAT rates

Always confirm the correct VAT rate before calculating.

See how VAT rates affect calculations: How VAT is calculated

Mistake 3: Confusing VAT Inclusive and VAT Exclusive Prices

Mixing up inclusive and exclusive prices often results in under- or over-charging VAT.

- VAT exclusive → VAT must be added

- VAT inclusive → VAT must be extracted

Clear explanation here: Inclusive and exclusive VAT prices

Mistake 4: Ignoring Reverse VAT Calculations

When VAT is already included, reverse calculation is required.

Correct approach:

Net price = Gross price ÷ (1 + VAT rate)

Skipping this step results in inaccurate VAT amounts.

Step-by-step guide: Calculate VAT Backwards

Mistake 5: Manual Calculation Errors

Manual calculations increase the risk of:

- Rounding mistakes

- Formula errors

- Inconsistent results

Using a VAT calculator reduces these risks significantly.

Try country-specific calculators:

How to Avoid VAT Calculation Mistakes

To stay accurate:

- Always identify if prices include VAT

- Use the correct VAT rate

- Apply the correct formula

- Double-check calculations

- Use VAT calculators when possible

External Reference

For official VAT calculation guidance, see:

European Commission VAT Basics

Frequently Asked Questions

What is the most common VAT calculation mistake?

Subtracting VAT directly from a gross price instead of dividing.

How can I avoid VAT errors?

Use the correct formula and confirm whether prices include VAT.

Are VAT mistakes serious?

Yes. They can lead to incorrect pricing and VAT reporting issues.

Key Takeaways

- VAT mistakes are common but avoidable

- Subtracting VAT directly is incorrect

- Reverse calculation is essential for inclusive prices

- VAT rates must be confirmed

- Calculators reduce error risk