Introduction

VAT tax calculation follows a clear structure, but many people find it confusing because VAT can be added, removed, or calculated backwards depending on how prices are shown. Whether you are a consumer checking receipts or a business preparing invoices, understanding the full VAT calculation process helps you avoid mistakes.

This complete guide explains VAT tax calculation from start to finish, covering net prices, VAT amounts, gross prices, and how VAT flows through businesses. While VAT rates vary by country, the calculation logic remains the same worldwide.

Table of Contents

- Steps

- Does VAT Tax Calculation Change by Country?

- How to Avoid VAT Calculation Mistakes

- External Reference

- Frequently Asked Questions

- Key Takeaways

Step 1: Start with the Net Price

The net price is the price before VAT is added.

VAT calculations always begin from the net price when VAT is not included.

Formula:

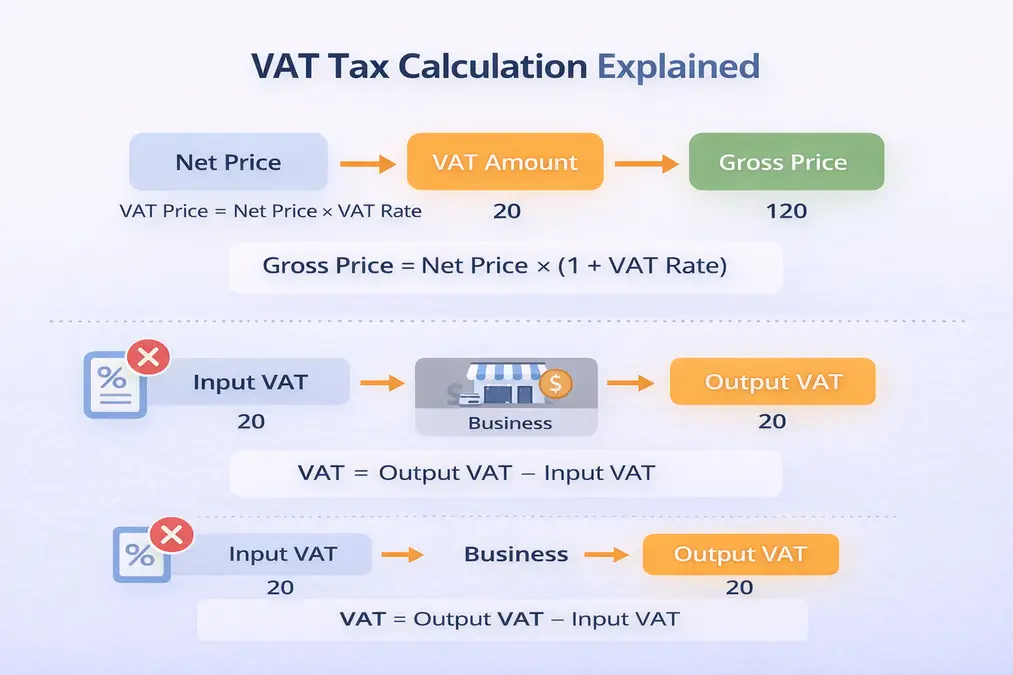

VAT amount = Net price × VAT rate

Learn more: Explained VAT calculation Formula

Step 2: Calculate the VAT Amount

The VAT amount is calculated as a percentage of the net price.

Example:

- Net price: 100

- VAT rate: 20%

- VAT amount: 20

This amount is added to the net price to get the final total.

Step 3: Calculate the Gross Price

The gross price is the final price including VAT.

Formula:

Gross price = Net price × (1 + VAT rate)

Detailed guide: Add VAT to price

Step 4: Understanding Input VAT and Output VAT

For businesses:

- Input VAT: VAT paid on purchases

- Output VAT: VAT charged on sales

The VAT payable is the difference between them.

Formula:

VAT payable = Output VAT − Input VAT

How VAT works in real life: VAT working system

Step 5: Calculating VAT from a VAT-Inclusive Price

When VAT is already included, reverse calculation is required.

Formula:

Net price = Gross price ÷ (1 + VAT rate)

Step-by-step explanation: Remove VAT from price

Common VAT Calculation Scenarios

VAT calculation is commonly required when:

- Pricing goods or services

- Issuing invoices

- Checking receipts

- Preparing VAT returns

Understanding each step ensures accurate totals.

Does VAT Tax Calculation Change by Country?

The method stays the same, but:

- VAT rates differ

- Some items may be exempt or zero-rated

Use country-specific calculators for accuracy:

- how to calculate VAT UK

- calculate UAE VAT online

- VAT exclusive calculator KSA

- VAT exclusive calculator Qatar

External Reference

For internationally accepted VAT principles, see:

OECD – International VAT/GST Guidelines

Frequently Asked Questions

What is VAT tax calculation?

VAT tax calculation is the process of determining VAT amounts and totals based on net or gross prices.

Is the VAT calculation formula the same everywhere?

Yes. Only VAT rates vary by country.

Can I calculate VAT manually?

Yes, but calculators reduce errors and save time.

Key Takeaways

- VAT calculation starts with the net price

- VAT amount is a percentage of the net price

- Gross price includes VAT

- Businesses calculate VAT using input and output VAT

- The method is global; rates vary